SOC Vs SOX: An In-Depth Analysis Of 6 Key Differences

SOC and SOX compliance are essential for ensuring reliable financial reporting and operational processes. This article explores their essence, complexities, significance, and differences and offers guidance for informed decision-making.

As an IT manager, you may find the overlapping terms and requirements of SOC (System and Organization Controls) and SOX (Sarbanes-Oxley Act) confusing. Understanding the distinctions is crucial for compliance and security, but the technical jargon can be overwhelming.

Misunderstanding the differences between SOC and SOX can lead to compliance issues, security risks, and wasted resources. You might struggle to ensure your organization meets all necessary requirements without clear guidance, causing stress and potential financial penalties.

By understanding the differences between SOC vs SOX, you'll be better equipped to navigate compliance requirements, enhance your organization's security posture, and ensure you're using your resources efficiently.

Let's know more about SOC and SOX.

What Is SOC Compliance?

SOC compliance, an acronym for System and Organization Controls, is a framework established by the American Institute of Certified Public Accountants (AICPA) to uphold standards and guidelines for service organizations. This framework evaluates and validates the controls and procedures these organizations implement.

SOC compliance is structured into various types: SOC 1, SOC 2, and SOC 3.

- SOC 1 compliance, denoted as Type 1, focuses on assessing internal controls directly linked to financial reporting. These assessments are instrumental in aiding auditors to gauge the impact of a service organization's operational processes on their clients' financial statements.

- In contrast, SOC 2 compliance, represented as Type 2, scrutinizes the effectiveness of controls pertaining to security, availability, processing integrity, privacy, and confidentiality within a service organization. This comprehensive evaluation ensures that the organization's systems and operations meet the highest security and reliability standards.

- Similarly, SOC 3 compliance, akin to SOC 2, encompasses assessments of security, availability, processing integrity, privacy, and confidentiality controls. However, SOC 3 reports are designed to be more generalized and can be publicly shared, providing stakeholders with valuable insights into the organization's commitment to safeguarding sensitive information and ensuring operational reliability.

How To Be SOC Compliant?

Achieving SOC compliance necessitates a structured approach to aligning organizational practices with established standards. Here's a brief guide:

- Undergo Independent Audit: Companies seeking SOC compliance must engage a third-party auditor to conduct an independent review. The auditor evaluates the organization's controls and processes to ascertain adherence to AICPA standards.

- Assessment of Controls: During the audit, the auditor meticulously assesses the effectiveness and reliability of the service organization's controls. This evaluation encompasses various aspects, including security measures, data privacy protocols, availability of services, processing integrity, and confidentiality safeguards.

- Audit Report Issuance: Following the audit, the third-party auditor compiles their findings into a comprehensive report. This report outlines the organization's compliance status, highlighting areas of strength and areas that may require improvement to meet SOC standards.

- Addressing Compliance Gaps: If any deficiencies or gaps in compliance are identified during the audit, the organization must take prompt corrective action. This may involve implementing additional controls, enhancing existing processes, or addressing security vulnerabilities to ensure alignment with SOC requirements.

- Continuous Monitoring and Improvement: Achieving SOC compliance is not a one-time endeavor but an ongoing commitment to maintaining robust controls and adhering to evolving regulatory standards. Continuous monitoring and periodic audits are essential to ensure sustained compliance and mitigate emerging risks effectively.By following these steps diligently, organizations can demonstrate their commitment to safeguarding customer data, maintaining operational integrity, and providing secure services in accordance with SOC standards. Achieving SOC compliance not only enhances trust and confidence among customers and stakeholders but also reinforces the organization's reputation as a reliable and security-conscious service provider.Now, let's explore the benefits of adhering to SOC compliance.

Key Benefits Of SOC Compliance

Here are some of the key benefits of implementing SOC compliance:

- Voluntary Compliance: Unlike SOX compliance, SOC compliance is voluntary, offering organizations flexibility in implementation while still demonstrating a commitment to robust internal controls.

- Demonstrates Internal Controls: SOC compliance provides tangible evidence of strong internal controls and information security practices, fostering trust among clients and stakeholders.

- Assists with SOX Compliance: SOC 1 compliance aids clients, especially publicly traded companies subject to SOX requirements, by showcasing the service provider's adherence to sufficient internal controls.

- Relevance for Tech Service Providers: SOC 2 compliance is particularly pertinent for technology service providers and SaaS companies handling customer data, assuring clients of the organization's capability to protect sensitive information.

- Enhances Customer Trust: Companies achieving SOC 2 compliance bolster customer trust by demonstrating a steadfast commitment to information security through robust controls and practices.

- Mitigates Risks: SOC compliance helps mitigate risks associated with financial misconduct, data breaches, and cyber threats by enforcing stringent internal controls and proactive risk management measures.

What Is SOX Compliance?

SOX compliance, short for the Sarbanes-Oxley Act, signifies a company's commitment to adhering to the regulations stipulated in the Sarbanes-Oxley Act of 2002, a federal legislation enacted in the United States. Governed by securities laws overseen by the Securities and Exchange Commission (SEC), SOX compliance mandates external auditors to conduct audits specifically tailored to ensure strict adherence to compliance standards.

Originating in response to notable financial scandals, the SOX Act aimed to enhance transparency and accountability within companies. It introduced a comprehensive set of regulations for public companies and firms, including provisions related to financial reporting and internal access controls.

How To Be SOX Compliant?

To achieve SOX compliance, companies must adhere to the regulations outlined in the Sarbanes-Oxley Act. Here's a concise guide:

- Establish Code of Ethics and Internal Controls: Companies should develop a robust code of ethics and implement internal controls to prevent fraudulent activities. These controls ensure accountability, transparency, and integrity in financial reporting and operational processes.

- Implement Financial Reporting Processes: Instituting regular financial reporting processes is essential to maintain accuracy and transparency in financial disclosures. Companies must establish mechanisms for timely and accurate reporting of financial information to stakeholders.

It's important to note that compliance with SOX is mandatory for all publicly traded companies in the United States. Failure to comply can result in significant fines, legal consequences, and damage to the company's reputation.

Therefore, adherence to SOX regulations is critical to maintaining trust and confidence among investors, regulators, and the public.Now, let's go through the benefits of meeting SOX compliance.

Key Benefits Of SOX Compliance

Below listed are some of the key benefits of implementing SOX compliance:

- Accountability and Legal Consequences: SOX holds management, accountants, and auditors accountable for accurate financial disclosure, imposing financial penalties and potential imprisonment for non-compliance.

- Guidance for Precise Financial Reporting: While not prescriptive on record-keeping methods, SOX delineates controls for precise financial reporting, emphasizing the role of Governance, Risk, and Compliance (GRC) professionals.

- Mandatory Internal Control Structure: Section 404 of SOX mandates management to establish and maintain a robust internal control framework for financial reporting, with an annual independent audit to validate its effectiveness.

- Documentation and Compliance Verification: SOX requires companies to document their Internal Controls for Financial Reporting (ICFR) during audits, showcasing compliance with SOX objectives and ensuring transparency in financial practices.

- Data Governance and Security Policies: SOX mandates firms to implement data governance and security policies to safeguard financial data, ensuring its protection and integrity.

- Protection of Interests and Investor Safeguarding: By incentivizing measures that protect both company and investor interests, SOX enhances corporate governance practices through the implementation of controls and standardized procedures.

Now, let's understand why it's important to adhere to SOC and SOX compliance.

Significance Of Enforcing SOX and SOC 2 Compliance

Adhering to SOC and SOX compliance is crucial for ensuring the reliability and integrity of financial reporting and operational processes within organizations. These frameworks help mitigate risks, enhance transparency, and foster trust among stakeholders, ultimately contributing to businesses' overall sustainability and success. However, the reasons aren’t limited to this. Below mentioned are the added reasons:

- To Maintain Financial Integrity:

SOX ensures accurate financial reporting, promoting transparency and reliability in financial statements. While, SOC focuses on controls related to security, availability, processing integrity, confidentiality, and privacy, safeguarding the integrity of financial information.

- To Enhance Stakeholder Trust:

By meeting these two compliance standards, organizations can provide assurance to stakeholders, including investors, customers, and partners, that the company follows rigorous standards for risk management and financial accuracy. By doing so, companies can build trust by showing a commitment to safeguarding sensitive data and maintaining strong internal controls.

- To Meet Legal Requirements:

SOX compliance is compulsory for all publicly traded companies in the U.S., and non-compliance can lead to legal consequences, fines, and damage to reputation. While SOC compliance is not legally required, it is often demanded by clients and partners to ensure data security and privacy.

- To Mitigate Risk:

Both frameworks help in identifying and mitigating risks associated with financial malfeasance, data breaches, and unauthorized access. Moreover, the implementation of controls and best practices reduces the likelihood of security incidents, protecting the company's assets and reputation.

- To Attain Competitive Advantage:

Companies adhering to SOX and SOC 2 compliance standards gain a competitive edge by showcasing their commitment to high standards of governance, risk management, and data security. Moreover, compliance can be a differentiator in the marketplace, attracting clients and partners who prioritize secure and reliable business practices.

- To Find Room For Continuous Improvement:

Compliance requires ongoing monitoring and improvement of internal controls and security measures, fostering a culture of continuous enhancement. It encourages companies to stay updated with evolving regulatory requirements and technological advancements to adapt and strengthen their practices.

Now, let's move on and understand the difference between SOC and SOX compliance.

SOC Vs SOX Distinction: Comparison Based On Different Parameters

Below, we have compared both SOC vs SOX compliance in a detailed manner. This distinction will help you understand how these two compliance standards are different from each other.

1. Purpose And Scope Of The Compliances

SOC vs SOX has different purposes and scopes, such as:

- OX, the Sarbanes-Oxley Act of 2002, serves as a regulatory framework primarily for publicly traded companies in the United States. Its core objective is to safeguard investors by ensuring accurate financial reporting. SOX mandates stringent internal controls within organizations and requires verification of the accuracy of financial statements.

- In contrast, SOC, or System and Organization Controls, comprises a set of guidelines established by the American Institute of Certified Public Accountants (AICPA). These guidelines are designed to ensure information systems' security, confidentiality, processing integrity, availability, and privacy. SOC compliance focuses on assessing and validating the controls and procedures implemented by service organizations, with a particular emphasis on safeguarding sensitive data and maintaining operational reliability.

While SOX emphasizes financial transparency and accountability within publicly traded companies, SOC compliance extends beyond financial reporting to encompass broader aspects of information security and system integrity within service organizations.

2. Uses Case: Which Type Of Industries Uses These Compliance

SOC vs SOX, both the compliances are applicable to different sectors, for instance:

- SOC compliance finds application across various industries, such as healthcare and medical practices, banking and investment firms, tax service providers, data centers, co-location service providers, and any organization prioritizing data security and privacy to prevent potential breaches.

- On the other hand, SOX compliance is predominantly utilized by publicly traded companies, private firms preparing for initial public offerings (IPOs), non-US-based publicly traded entities, and wholly-owned subsidiaries of publicly traded organizations. These entities are mandated to adhere to SOX regulations to ensure transparency and accuracy in financial reporting and internal controls.

3. Regulatory focus

- SOC and SOX compliance exhibit distinct regulatory focuses. SOC primarily emphasizes internal controls to ensure financial reports' consistency, accuracy, and completeness. It aims to bolster auditability within organizations and facilitate the detection of internal fraud or theft.

- In contrast, SOX represents a governmental initiative targeting the financial sector to mitigate financial fraud and promote transparency. These federal laws were enacted in response to a series of corporate scandals that severely eroded investor confidence.

4. Applicability

- SOC compliance is applicable to any organization providing services to other entities and dealing with sensitive data through storage, processing, or transmission. Regardless of size or industry, organizations can leverage SOC reports to demonstrate compliance with industry security standards and best practices.

- In contrast, SOX is applicable exclusively to publicly traded companies listed on U.S. stock exchanges or submitting financial statements to the Securities and Exchange Commission (SEC).

5. Reporting Requirements

SOC vs SOX both have different reporting requirements, such as:

- SOX necessitates companies to file annual reports with the SEC, which include an assessment of the effectiveness of their internal controls pertaining to financial reporting.

- In contrast, independent auditors produce SOC reports, evaluating an organization's controls and procedures according to the AICPA's Trust Services Criteria. These SOC reports provide assurance to customers, partners, and stakeholders, demonstrating the presence of adequate controls to protect sensitive data.

6. Levels of Assurance

SOC and SOX compliance offer distinct levels of assurance tailored to organizations' needs and the type of assurance sought:

- SOC audit reports provide varying levels of assurance depending on the type issued. SOC 1 reports assure the design and operational effectiveness of controls associated with financial reporting for a service organization. SOC 2 reports offer assurance on controls related to security, availability, processing integrity, confidentiality, and privacy. SOC 3 reports provide a high-level overview of a service organization's controls and are often used for marketing purposes.

- In contrast, SOX offers investors substantial confidence in the accuracy and reliability of financial statements presented by public companies.

SOC vs SOX: Comparison Table

Here’s an overview of SOC vs SOX:

After closely comparing both compliance frameworks, you might have gained a better understanding of their differences. But there is a common question that often arises: Which one is more applicable to our organization? Well, to find out the answer, read on further.

SOC vs SOX: Which One To Choose For Your Organization?

The decision to comply with SOC or SOX depends on your organization's specific needs and objectives, as both frameworks serve distinct purposes.

- SOX compliance is mandatory for all publicly traded U.S. companies, focusing primarily on financial reporting. It requires companies to establish internal controls to ensure the accuracy of financial statements, including measures for monitoring transactions, record-keeping, and conducting internal audits.

- In contrast, SOC compliance is optional and applies to companies providing services to others, focusing on safeguarding data and maintaining privacy. SOC reports assess how a company manages data processing, storage, and transmission, demonstrating commitment to data security. Customers or partners may request these reports during due diligence checks.

If your company is publicly traded, compliance with SOX is obligatory. However, even for non-publicly traded companies, adhering to SOX can strengthen financial controls and bolster investor confidence. On the other hand, for companies providing services or handling sensitive data, SOC compliance may be more suitable, showcasing a commitment to data security and privacy that can enhance competitiveness in the market.

Ultimately, it's advisable to consult legal or compliance experts to determine which set of regulations aligns best with your company's goals and requirements.

But can both the SOC and SOX compliance work together? Let’s find out.

The Interplay of SOC & SOX in Financial Reporting: CAN SOC vs SOC Work Together?

Yes, SOC and SOX compliance can work together in a coordinated manner, complementing each other in certain aspects:

- Internal Controls Alignment:

- SOX emphasizes internal controls over financial reporting.

- SOC 1, a component of SOC, specifically addresses controls related to financial reporting, aligning with SOX requirements.

- Result: A unified approach to internal controls, ensuring consistency in managing financial reporting processes.

- Third-Party Service Providers:

- Many organizations outsource functions to third-party service providers.

- SOC reports, assess the controls implemented by these service providers, ensuring the reliability of outsourced processes.

- Result: SOX-compliant companies can leverage SOC reports to evaluate and manage the effectiveness of controls over outsourced activities impacting financial reporting.

- Audit Efficiencies:

- External auditors conducting SOX compliance audits may consider SOC reports as part of their procedures.

- A clean SOC report can serve as evidence of effective controls, potentially streamlining the scope and effort required for SOX compliance audits.

- Result: Improved audit efficiency and potentially reduced duplication of efforts.

- Risk Management Integration:

- Both SOC and SOX frameworks contribute to overall risk management practices within an organization.

- SOC reports, especially SOC 2, address a broader range of control objectives beyond financial reporting, enhancing the overall risk management posture.

- Result: A comprehensive risk management approach that encompasses financial reporting controls and extends to other critical areas.

- Enhanced Reporting Practices:

- SOC standards offer a broader framework for assessing and reporting on controls related to various aspects of service organizations.

- SOX compliance benefits from SOC reporting practices, incorporating insights into a wider range of control objectives.

- Result: Improved reporting practices that go beyond financial reporting, providing a more holistic view of internal controls.

This collaboration ensures a robust and unified approach to compliance, addressing not only financial reporting but also broader organizational control objectives.

Navigating the complexities of compliance with frameworks like SOC and SOX can be challenging. Fortunately, solutions exist in the market to assist organizations in meeting these stringent regulations and others. One standout solution is Zluri. It is an access review platform that helps you to adhere to evolving compliance regulations by implementing controls and following all the security norms. Let’s have a quick look at how Zluri’s access review does all this.

Zluri: Your Go-To-Solution To Comply With Stringent Compliance Regulations

Zluri’s access review conducts regular or periodic evaluations of users' permissions, what they have access to whether the access they hold is relevant for their role or not. This proactive strategy not only ensures effective user access management and strengthens data security but also ensures adherence with compliance standards like SOX and SOC standards. However, this provides a glimpse into its compliance adherence, let's delve into its broader capabilities.

Automate User Access Review

Zluri's Access Review automates the entire user access assessment process from identifying which user has access to which data and apps to help reviewers modify or restrict user permissions accordingly. Also, it is highlighted in Kuppingercole's research and analysis report that by automating this process, Zluri’s access review eliminates the error-prone and time-consuming nature of manual reviews.

Manual reviews can be challenging, with the potential for oversight of critical unauthorized access permissions and Zluri understands the concern and through automation it addresses these challenges effectively.

Thoroughly Monitors Critical User Access Permissions

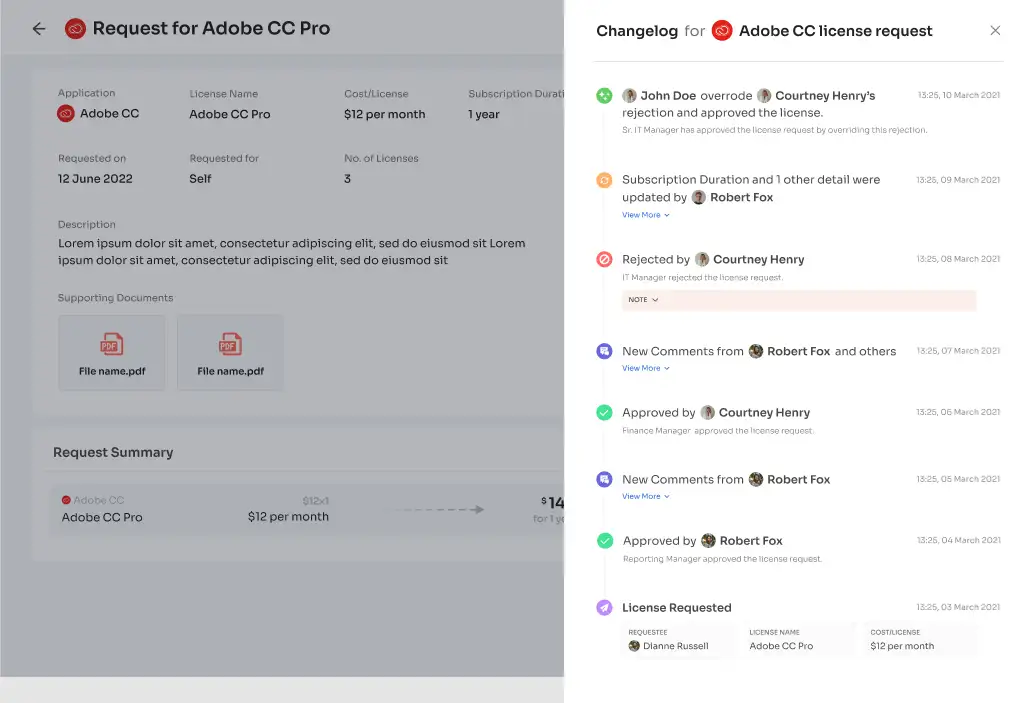

With Zluri's Access Review, your IT teams can gain a holistic view of user permissions. This includes identifying unauthorized access and permissions unrelated to users' designated job roles. Furthermore, through continuous monitoring, the platform ensures that your IT teams stay vigilant, promptly detecting any discrepancies in access rights.In the image below, you can see the complete history of permissions and identify any scopes of unathorized accesses in your organization.

This visibility comes in handy as it allows the IT team to align user access permissions with their respective roles within the organization. By doing so, they can mitigate the risks associated with providing users with more access than necessary (over-provisioning), which can potentially compromise sensitive data.

Enforces Access Control Policies

Zluri's Access Review goes beyond the basics, elevating security measures by implementing additional layers of protection. It enforces crucial security policies such as Segregation of Duty (SoD), Role-Based Access Control (RBAC), the Principle of Least Privilege (PoLP), and Just-in-Time access. These policies are not only best practices for effective access management but are also mandated by various compliance regulations such as SOX and SOC.

By diligently enforcing these security measures, Zluri's Access Review ensures the safety and security of critical data. Simultaneously, it establishes a well-governed access environment, aligning with industry standards and regulatory requirements.

Conduct Audits And Generate Curated Reports

Zluri’s access review conducts periodic audits. These audits involve the reviewing of existing access permissions. And once the review is completed successfully, it generates reports. These reports help identify unauthorized users or those accessing critical applications with a high-risk profile. This proactive approach allows your team to implement security measures to protect sensitive SaaS app data from potential breaches.

Additionally, these documents' access logs/audit trails act as evidence to show the auditors that regulatory compliance rules (SOC and SOX) are met, and security policies are enforced effectively. In the below image, you can see Zluri’s audit logs and maintain complete transparency with your auditors.

Now that you're aware of the benefits offered by Zluri’s access review, why not book a demo now? This way, you can experience it firsthand and see how it practically works.

FAQs

Is GAAP And SOX The Same?

No, they differ. GAAP is a collection of generally accepted principles, while SOX is a legal regulation (a law).

Is SOX Applicable In India?

The Sarbanes-Oxley (SOX) compliance is a United States federal law, and it's primarily applicable to companies listed on U.S. public company boards. Therefore, the direct legal obligations of SOX do not apply to companies in India or other foreign companies outside the United States.

What Is a SOC Analyst?

A Security Operations Center (SOC) analyst is an IT security specialist responsible for monitoring an organization's network and system infrastructure to detect potential threats.

Go from SaaS chaos to SaaS governance with Zluri

Tackle all the problems caused by decentralized, ad hoc SaaS adoption and usage on just one platform.

.webp)

.webp)

.webp)

.webp)